Families

Are you working and have the ABILITY TO PAY bills on time? Are you WILLING PARTNER with us? If you said yes, consider applying for a Habitat for Humanity home and starting your journey toward homeownership.

Do You Have a Need for Safe, Affordable Housing?

Home Ownership

Habitat Collin County is always looking for families needing decent, affordable housing to help keep their families safe, healthy, and strong. With each Partner Family added, our Habitat family grows. We have a strong relationship with our families, beginning with the qualification phase, then throughout the construction process and sweat equity work. Even after closing on their home, we will keep them informed about what is going on in our affiliate and ways they can be a part of our mission. Becoming a Habitat family can be a 12-18 month journey.

Benefits

of Habitat Ownership

Zero equivalent interest on

a mortgageAffordable monthly payments

Attractive, well-constructed homes

Brand appliances

Energy-efficient homes with low

utility costsBuilt to meet the family’s size needs

Currently building townhomes in McKinney

What Applicants Can Expect

-

1. Families will be paired with a mentor to help them assimilate and understand the Habitat organization and take the steps necessary to homeownership.

-

2. Families that meet the Habitat criteria will be given a plan of action to work towards qualifying.

-

3. Applicants will attend our Family Seminar and learn about our Habitat Homeownership Program.

Everyone Deserves a

Decent Place to Live

We can help you buy a home you love with a mortgage you can afford.

Homeowner Profiles

Are you interested in purchasing your first home through Habitat?

Income Guidelines

Are you a U.S. citizen or a permanent legal resident of the U.S.?

Are you currently living and working in Collin County?

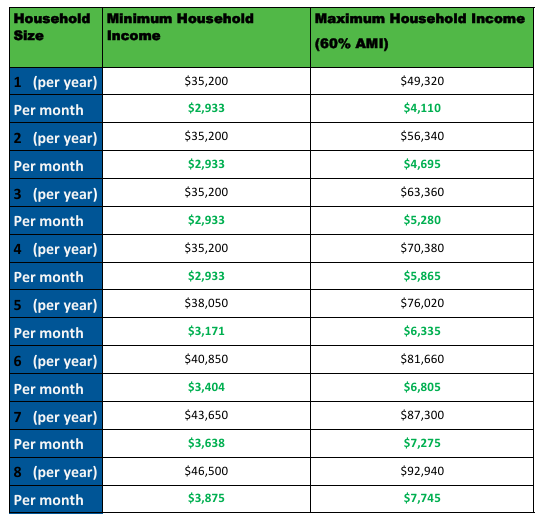

Does your income fall between 30%-60% of the area median income levels before taxes for our area, depending on your family size?

Do You Qualify for a Habitat Home?

Application process

-

When given the application, complete and return by the deadline. Habitat for Humanity is located at 2060 Couch Drive in McKinney, TX 75069. Habitat will conduct a sexual offender criminal background check and a credit check for the applicant.

Step 3: Gather Required Documentation

Applicants will gather the required documents for consideration of their application. Documents should be given to the Family

Programs staff member. Once all documents have been submitted, the application will be reviewed by Habitat staff.

Collect and save W-2 statements from all your employers for the past two years.

Collect and save your tax returns for the past two years with all schedules. You can request transcripts for free by calling 1-800-829-1040.

Save your pay stubs. You will need two months of pay stubs when you apply.

Save all your bank account statements (checking and savings). You’ll need two months of these when you apply.

Gather complete addresses and telephone numbers for Landlords, Employers for the last two years, and Banks where you have accounts.

If this applies to you, gather copies of all bankruptcy papers and divorce or separation papers.

Make sure you have a photo ID and a Social Security Card.

Start taking care of debts on your credit report; you’ll have to clear any judgments. You can get your free credit report by calling 877-322-8228 or from www.annualcreditreport.com.

Provide photo ID, proof of residency, and citizenship/legal resident status.

Last two months utility bills.

Current credit card statements on all open accounts.

-

Applicants will be invited to attend a Family Seminar to find more information about Habitat Homeownership Programs.

-

Applicants will gather the required documents for consideration of their application. Documents should be given to the Family Programs staff member. Once all documents have been submitted, the application will be reviewed by Habitat staff.

Collect and save W-2 statements from all your employers for the past two years.

Collect and save your tax returns for the past two years with all schedules. You can request transcripts for free by calling 1-800-829-1040.

Save your pay stubs. You will need two months of pay stubs when you apply.

Save all your bank account statements (checking and savings). You’ll need two months of these when you apply.

Gather complete addresses and telephone numbers for Landlords, Employers for the last two years, and Banks where you have accounts.

If this applies to you, gather copies of all bankruptcy papers and divorce or separation papers.

Make sure you have a photo ID and a Social Security Card.

Start taking care of debts on your credit report; you’ll have to clear any judgments. You can get your free credit report by calling 877-322-8228 or from www.annualcreditreport.com.

Provide photo ID, proof of residency, and citizenship/legal resident status.

Last two months utility bills.

Current credit card statements on all open accounts.

-

Click the button below to access the online form that can be completed online.

-

Click on the button below to access a printable checklist of documents needed to complete your application to make sure you have copies of everything you need to submit.

Sweat Equity Hours

Invest 250 to 500 hours of sweat equity hours to qualify for a Habitat home.

Sweat Equity Hours is the term we use to determine the time a homebuyer

volunteers. After signing the Letter of Intent (LOI), each qualified Partner Family

must complete between 250-500 sweat equity hours before closing and moving

into the house. Friends and family may complete up to 50 hours.How do I earn Sweat Equity Hours?

Work at a home building project or in the Habitat ReStore.

Attend monthly educational meetings.

Follow through on their financial goals toward homeownership.

Annual/monthly educational meetings.

Follow through on financial goals toward homeownership